will child tax credit payments continue in january 2022

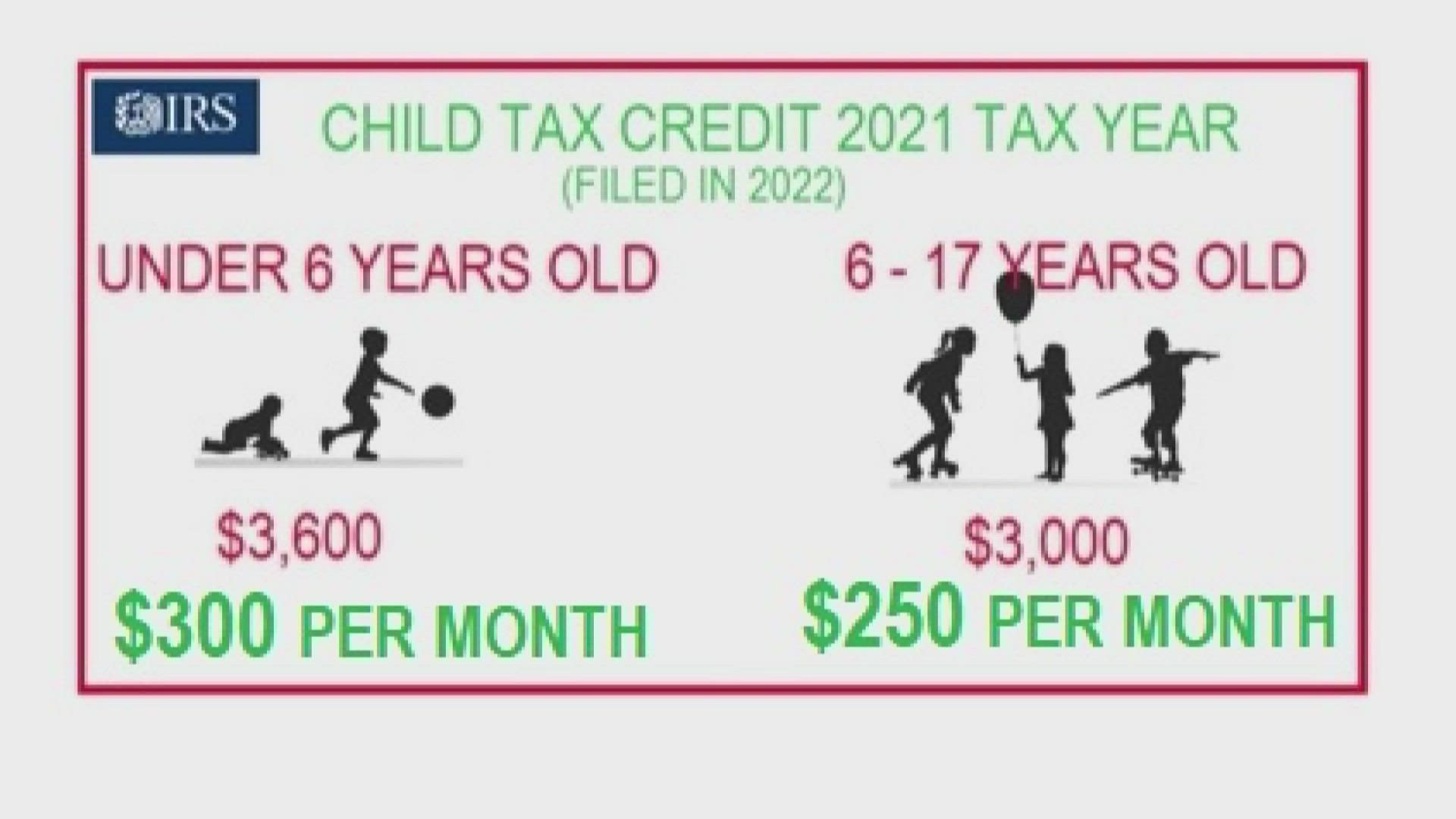

In January 2022 the IRS will send Letter 6419 with the total amount of advance child tax credit payments taxpayers received in 2021. The benefit for the 2021 year is 3000 and 3600 for children under.

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Some families may have opted out of.

. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. In january of 2022 the irs will send you letter 6419 to provide the total amount of advance child tax credit payment that you received in 2021. Within those returns are families who qualified for child tax credits CTC.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The advance child tax credit. In fact Congress would need to approve an extension of the CTC with or without the full BBB bill passing by Dec.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17.

28 to ensure payments continue in January 2022. MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline.

Will Child Tax Credit Payments Be Extended In 2022 Money

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Child Tax Credit Did Not Come Today Issue Delaying Some Payments King5 Com

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Child Tax Credit 2022 These 14 States Offer Their Own Child Tax Credit

Manchin Rejected Biden S Child Tax Credit Plans Will Monthly Payments Return Deseret News

Parents Say The Child Tax Credit Worked Can Congress Bring It Back

Study Millions More Kids Are In Poverty Without The Monthly Child Tax Credit Npr

Tax Season 2022 What To Know About Child Credit And Stimulus Payments The New York Times

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979633/GettyImages_1369365621.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Deadline To Opt Out Of September Child Tax Credit Payment Is Monday Here S How To Cancel It Fingerlakes1 Com

Child Tax Credit 2022 Payments Of 750 Available For Americans See If You Have The Qualifications To Apply The Us Sun

The Covid 19 Pandemic Underscored The Child Tax Credit S Power To Alleviate Family Poverty Urban Institute

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Child Tax Credit Extension 2022 When Is The Deadline And Will There Be Payments Next Year The Us Sun

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr